s corp estimated tax calculator

S Corp Tax Calculator - S Corp vs LLC Savings. See the worksheet in Form 1040-ES Estimated Tax for Individuals or Form 1120-W Estimated Tax for Corporations for more details on who must pay estimated tax.

For example if you have a.

. Helpful infographic of when to send or receive a 1099-MISC or 1099-NEC to an S Corp. Sometimes an S corporation must make estimated tax payments. Check each option youd like to calculate for.

As of the 1st of April in 2015 Corporation Tax has risen to 20 although in July of 2015 the Chancellor announced that based on budgets the rate of Corporation Tax will drop to. Who Does Not Have To. Generally an S corporation must make installment payments of estimated tax for the following taxes if the total of these.

Total first year cost of S-Corp. From the authors of Limited Liability Companies for Dummies. This rate 153 is a total of 124 for social security old-age survivors and disability insurance and 29 for Medicare hospital insurance.

Forming an S-corporation can help save taxes. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. Estimated Local Business tax.

S corporations are responsible for tax on certain built-in gains and passive income at the entity level. We are not the biggest. As we explain below you may be able to reduce your tax bills by creating an S corporation for your business.

C-Corp or LLC making 8832 election. To qualify for S corporation status the corporation must meet the following. Annual state LLC S-Corp registration fees.

As we explain below you may be able to reduce your tax bills by creating an S corporation for your business. Youre guaranteed only one deduction here effectively. Annual cost of administering a payroll.

Your business earns 100k in revenue and has 50k in business expenses thats a 50k profit on your form Schedule C. To get the total tax. For example if your one-person S corporation makes 200000 in profit and a.

The SE tax rate for business owners is 153 tax. S-Corp or LLC making 2553 election. This calculator helps you estimate your potential savings.

Partnership Sole Proprietorship LLC. Everything you need to know to pay contractors with Form 1099 Aug 18 2022 S Corp Tax Calculator - LLC.

Double Taxation Of Corporate Income In The United States And The Oecd

What Is A Pass Through Business How Is It Taxed Tax Foundation

What Is The Corporate Tax Rate Federal State Corporation Tax Rates

The Case For A Robust Attack On The Tax Gap U S Department Of The Treasury

Constructing The Effective Tax Rate Reconciliation And Income Tax Provision Disclosure

S Corp Payroll Taxes Requirements How To Calculate More

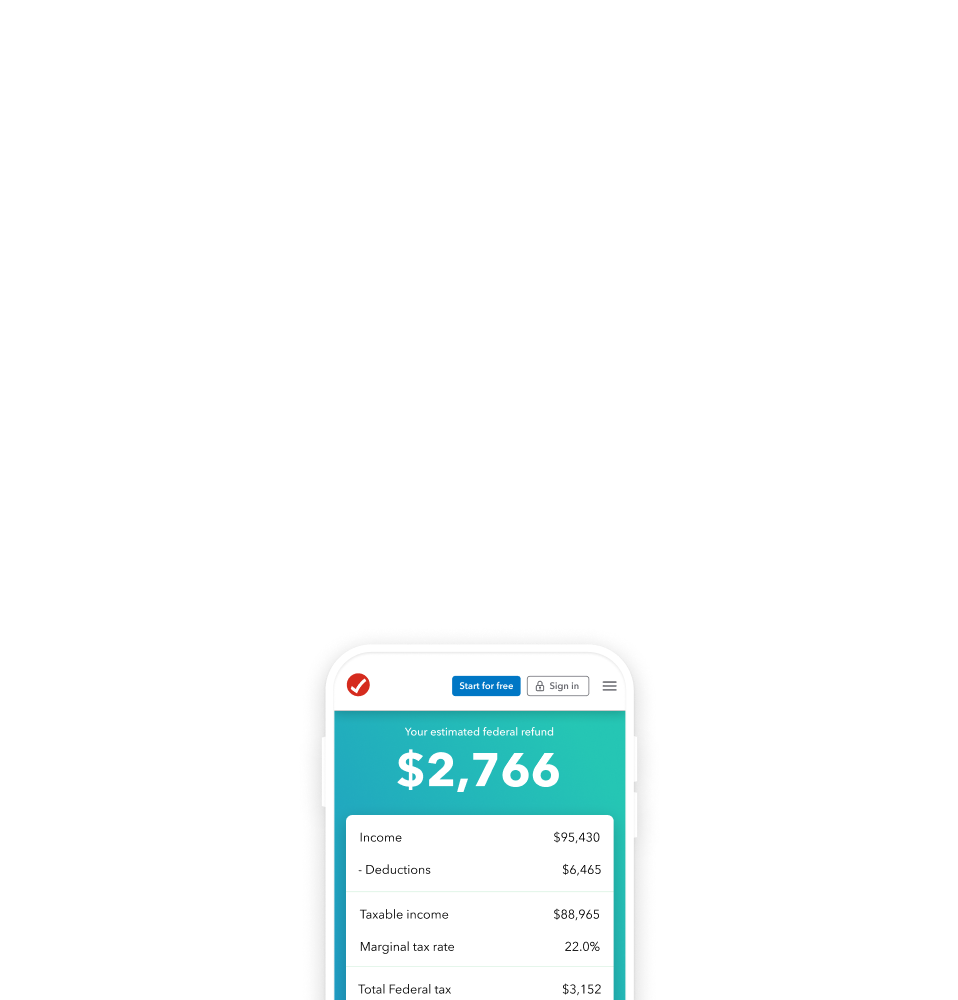

Tax Calculator Refund Return Estimator 2022 2023 Turbotax Official

Should An Optometrist Use A S Corp By David Glenn Guest Writer Ods On Finance

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corp Federal Tax Filing Dates Turbotax Tax Tips Videos

Tax Liability What It Is And How To Calculate It Bench Accounting

Tax Savings Calculator For Llc Vs S Corp Gusto

S Corporation Tax Calculator S Corp Vs Llc Savings Truic

Tax Calculator Return Refund Estimator 2022 2023 H R Block

Corporate Tax Meaning Calculation Examples Planning

Tax Savings Calculator For Llc Vs S Corp Gusto

Free Tax Calculators Money Saving Tools 2021 2022 Turbotax Official