pay utah state property taxes online

What you need to pay online. This web site allows you to pay your Utah County real property taxes online using credit cards debit cards or electronic checks.

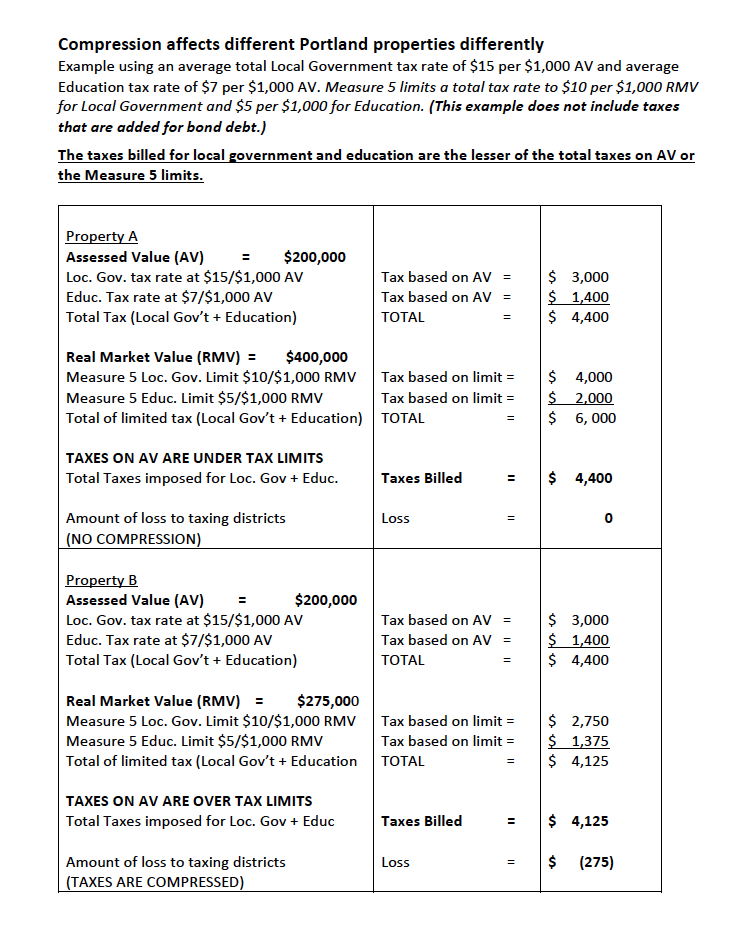

Property Taxes Compression Ballot Measures League Of Women Voters Of Portland

Payment Types Accepted Online.

. Payments by credit card may be made either online at taputahgov or over the phone by calling 801-297-7703 800-662-4335 ext. Ad See If You Qualify For IRS Fresh Start Program. Pay for your Utah County Real Property tax Personal Property tax online using this service.

What You Need To Pay Online. They conduct audits of personal. Pay over the phone by calling 801-980-3620 Option 1 for real property.

Based On Circumstances You May Already Qualify For Tax Relief. File electronically using Taxpayer Access Point at. If paying after the listed due date additional amounts will be owed and billed.

Free Case Review Begin Online. 7703 The Utah State Tax Commission accepts Visa. Utah Property Taxes Utah State Tax Commission You will pay the remaining balance or have the option to.

If paying after the listed due date additional amounts will be owed and billed. If you have questions please call 801-451-3243. Ad Get Instant Access to the Most Advanced Home Search Website in Utah.

You may pay your tax online with your credit card or with an electronic check ACH debit. You will need your property. Your property serial number Look up Serial Number.

We encourage payment of property taxes on this website see link below or IVR payments at 877 690-3729 Jurisdiction Code 5450. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov. Free Case Review Begin Online.

Property Taxes may be paid by cash check cashiers check or money order in the Treasurers Office. If a credit card is used as the method of payment the following. The County Commission approves the annual budget.

Online payments may include a service fee. File electronically using Taxpayer Access Point at. Step 1 - Online Property Tax Payments.

Click the link above to be directed to TAP Utahs Taxpayer Access Point DO NOT LOGIN OR CREATE A LOGIN Go to Payments and select either Make e-Check Payment or. Your Personal Property Account Number. Ad See If You Qualify For IRS Fresh Start Program.

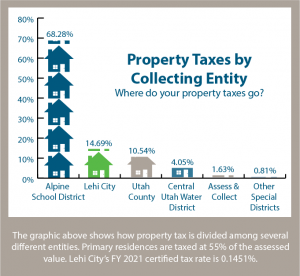

To pay Real Property Taxes. The Treasurers Office sends out the final tax bill receives property tax payments and distributes the funds to the various taxing entities. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

Step 1 Read and accept the Terms and Conditions. The Personal Property Team within the Property Tax Division develops depreciation schedules used by assessors in the valuation of personal property. Pay for your Utah County Real Property tax Personal Property tax online using this service.

Create an Account Today and Receive Exclusive Discounts. Step 1 - Online Property Tax. Payments can be made online by e-check ACH debit at taputahgov.

The Treasurers Office is open between 800 AM. Follow the instructions at taputahgov. Create an Account Today and Receive Exclusive Discounts.

This web site allows you to pay your Utah County Personal Property Taxes online using credit cards debit cards or electronic checks. Ad Get Instant Access to the Most Advanced Home Search Website in Utah. Official site of the Property Tax Division of the Utah State Tax Commission with information about property taxes in Utah.

This page is Step 1 Step 2 Enter Parcel Number or use the Parcel Address lookup. Based On Circumstances You May Already Qualify For Tax Relief. All Utah sales and use tax returns and other sales-related tax returns must be filed electronically beginning with returns due Nov.

Step 3 Review the taxes due and then add the.

Property Taxes When To Consider An Appeal Choose Park City Luxury Real Estate Agents

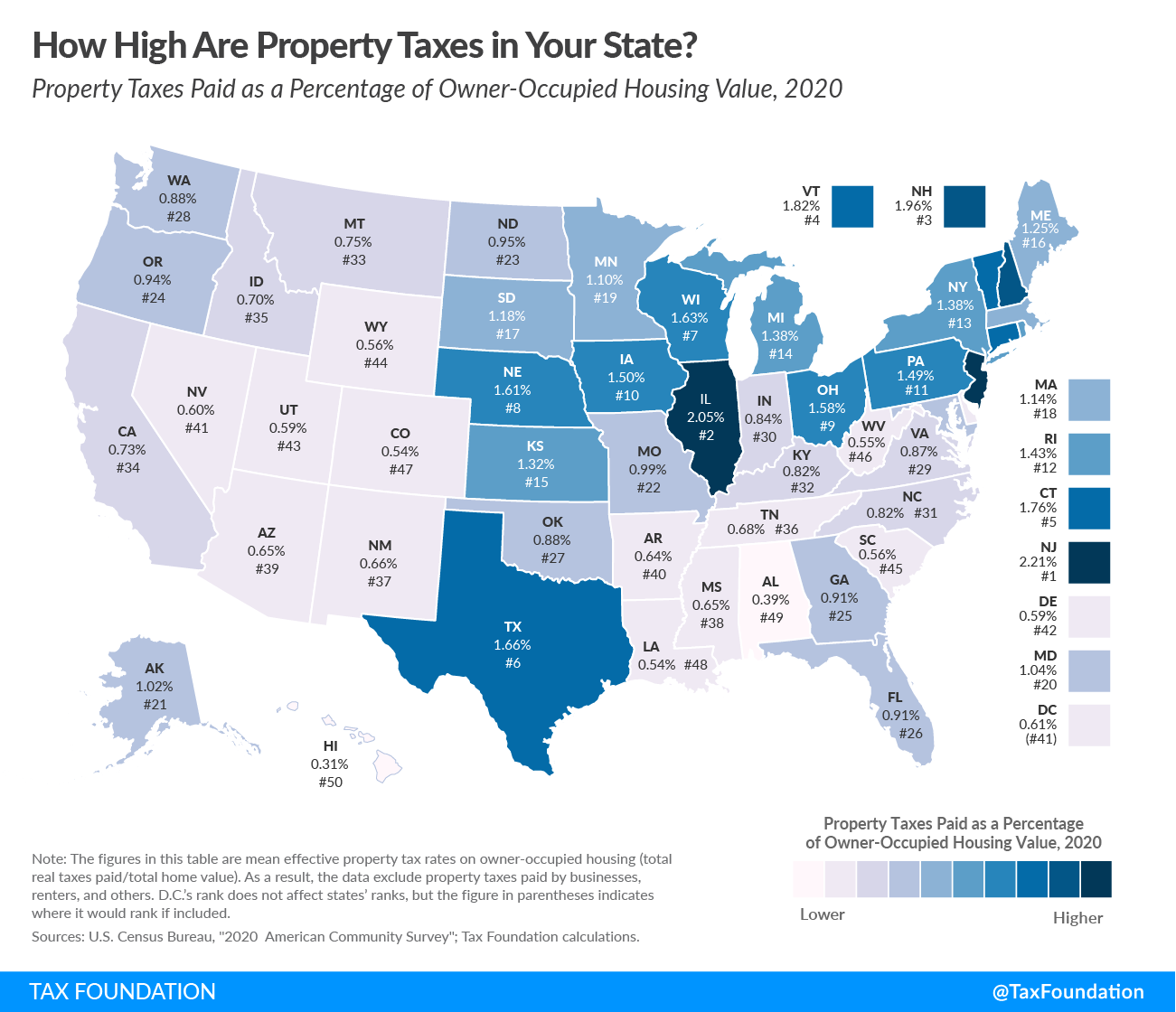

Utah Tax Rates Rankings Utah State Taxes Tax Foundation

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Taxes Sandy City Ut Official Website

Utah Property Taxes Utah State Tax Commission

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Property Tax How To Calculate Local Considerations

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Property Taxes Sandy City Ut Official Website

2022 Property Taxes By State Report Propertyshark

Riverside County Ca Property Tax Calculator Smartasset

Property Taxes How Much Are They In Different States Across The Us

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota Retirement Advice

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom